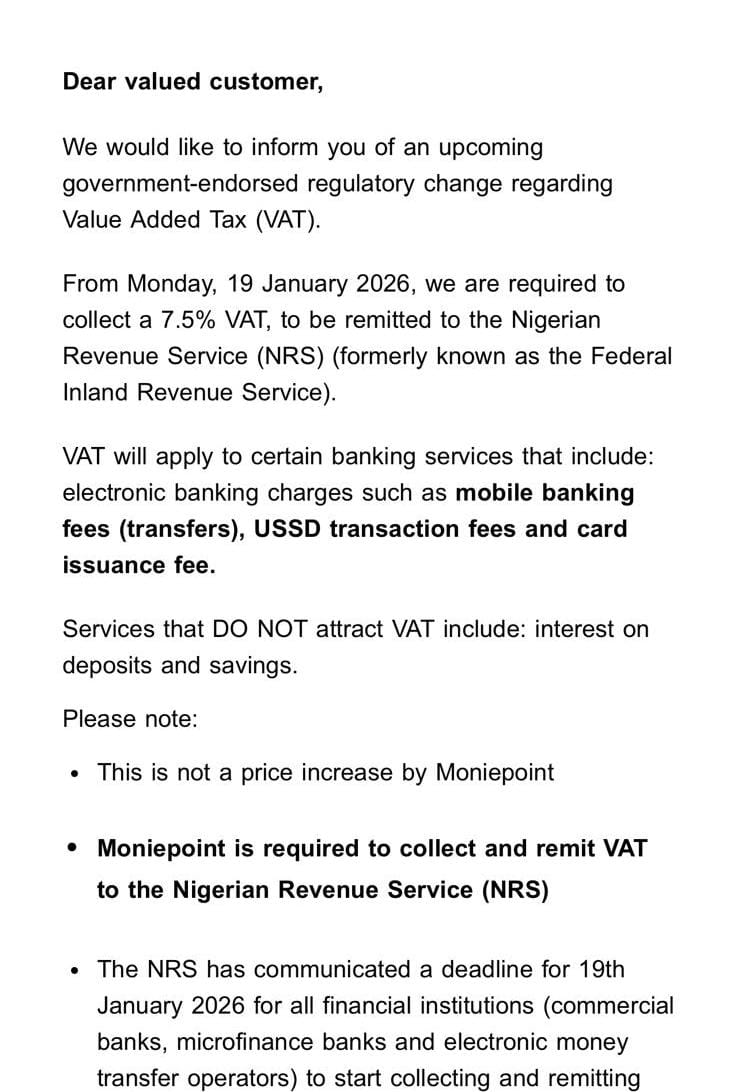

Government Mandates 7.5% VAT on Mobile Transfers and USSD Transactions Starting January 19, 2026

Nigerians will start paying 7.5% Value Added Tax (VAT) on mobile banking transfers, USSD transactions, and card issuance fees beginning Monday, January 19, 2026. The directive comes from the Nigerian Revenue Service (NRS), aimed at collecting taxes on digital financial services.

- The VAT applies only to service charges levied by banks and fintechs, such as transfer fees and USSD session charges, not on deposits or savings interest.

- Banks and fintech platforms will collect the tax on behalf of the government and remit it directly to the NRS.

- Customers will see the VAT itemised separately on their transaction statements for transparency.

With this new VAT, Nigerians using mobile banking and USSD services will incur slightly higher transaction costs. For example, a ₦25 transfer fee will attract an additional ₦1.88 VAT, bringing the total to ₦26.88 per transaction.

Fintech companies, including Moniepoint and other mobile banking platforms, have begun notifying customers about the upcoming VAT to ensure smooth compliance.

The new measure underscores the government’s push to increase revenue from digital financial transactions, reflecting the growing shift towards a cashless economy in Nigeria. Users are encouraged to monitor transaction fees and plan accordingly to avoid surprises on their statemen.