NRS Says VAT Targets Bank Service Fees, Not Funds Transferred by Customers

In a statement released on Thursday, the revenue agency explained that no new VAT has been introduced on bank transactions, contrary to claims circulating on social media and some online platforms.

VAT Applies to Bank Charges, Not Customers’ Money

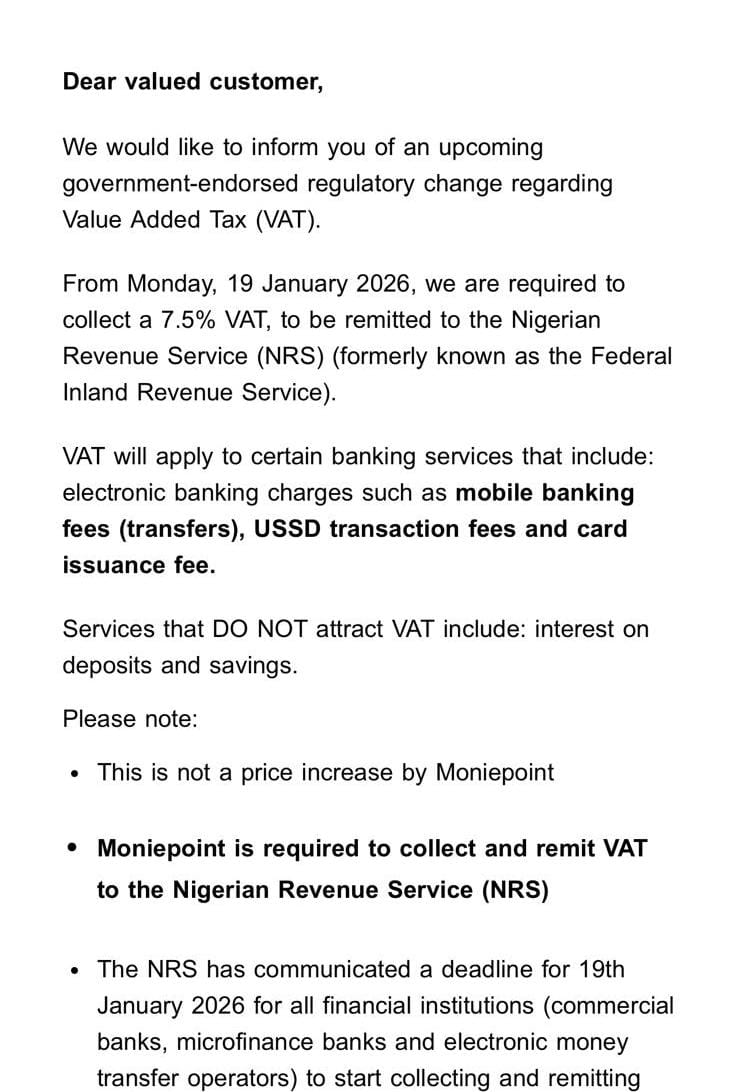

According to the NRS, VAT has always applied to banking service charges, including transfer fees, USSD charges, and other electronic service fees charged by banks and financial technology companies.

The agency stressed that the VAT is imposed on the service fees collected by banks, not on customers’ deposits, withdrawals, or transferred funds.

“Account holders are not being asked to pay VAT on their transactions. VAT is applicable only to charges and commissions earned by banks, as provided under existing tax laws,” the NRS stated.

The NRS clarified that recent discussions around VAT on electronic banking services stem from the enforcement and clarification of existing tax provisions, not the introduction of a fresh tax policy.

It further noted that banks and fintech companies are responsible for collecting and remitting the 7.5 percent VAT on applicable service charges to the government.

The clarification follows public outrage after reports suggested that Nigerians would begin paying VAT on every bank transfer starting January 19, 2026. The NRS described such reports as misleading, urging Nigerians to rely on verified information.

What This Means for Nigerians

- ✅ Nigerians will not pay VAT on the amount they transfer or receive

- ✅ VAT applies only to bank service charges

- ✅ Banks and fintech firms will collect and remit the VAT, not customers directly

- ❌ No new tax has been introduced on personal bank transactions

The Nigerian Revenue Service reassured Nigerians that the VAT framework for banking services remains unchanged, urging calm amid rising concerns. The agency emphasized that the goal is improved tax compliance by financial institutions, not additional financial burden on account holders.